Property Taxes In Virginia . personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. The lowest property tax rate, is 0.41% in bath. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. the highest property tax rate, in virginia is 1.20% in manassas park city. property taxes in virginia are calculated by multiplying a home’s assessed value by its total property tax rate. Assessed value is determined by. The average effective property tax rate in virginia is 0.81%, but this can vary quite a bit depending on which. the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. property taxes in virginia.

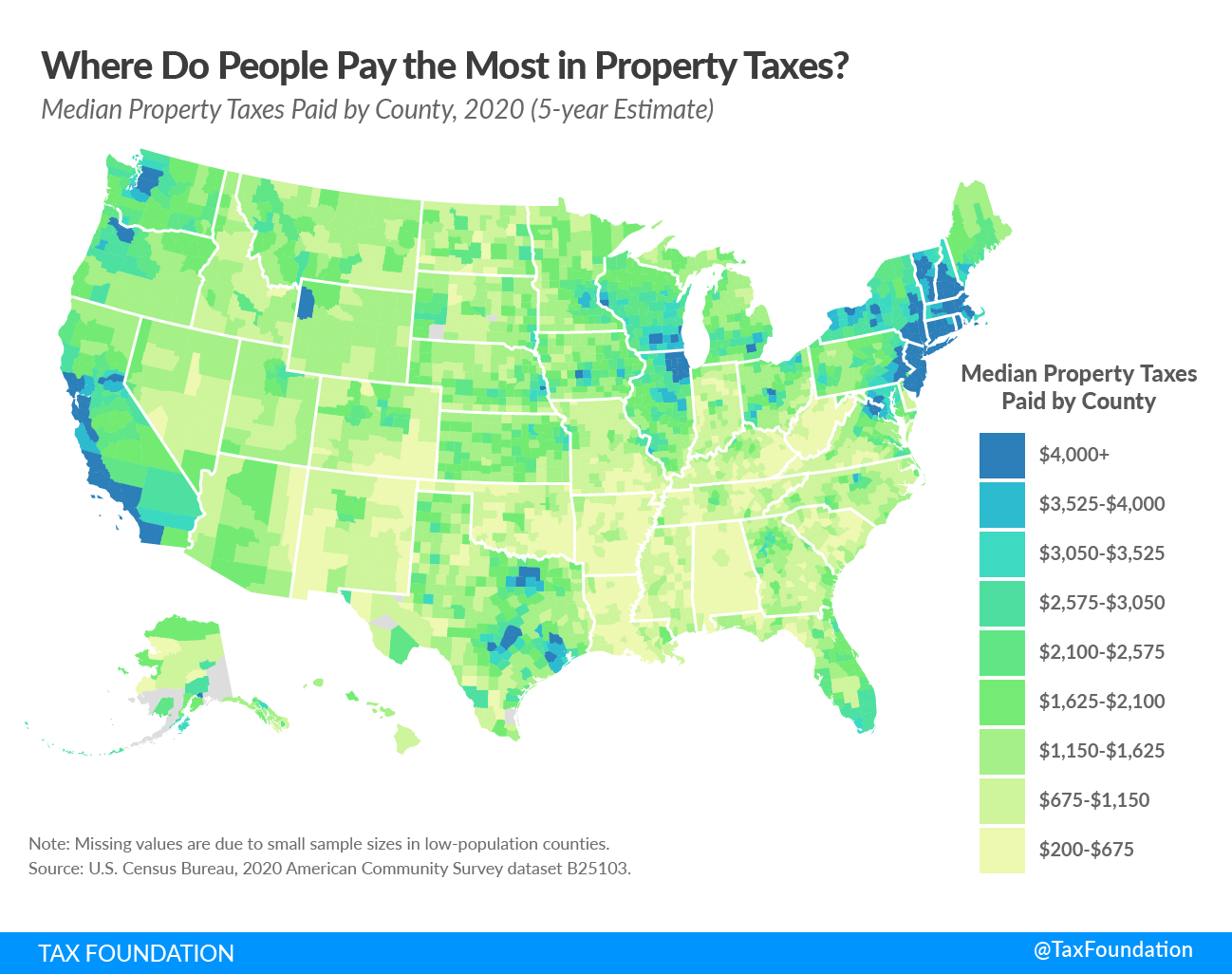

from taxfoundation.org

property taxes in virginia are calculated by multiplying a home’s assessed value by its total property tax rate. Assessed value is determined by. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. The average effective property tax rate in virginia is 0.81%, but this can vary quite a bit depending on which. the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. the highest property tax rate, in virginia is 1.20% in manassas park city. The lowest property tax rate, is 0.41% in bath. property taxes in virginia. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and.

Property Taxes by State & County Median Property Tax Bills

Property Taxes In Virginia property taxes in virginia. The average effective property tax rate in virginia is 0.81%, but this can vary quite a bit depending on which. property taxes in virginia are calculated by multiplying a home’s assessed value by its total property tax rate. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. property taxes in virginia. The lowest property tax rate, is 0.41% in bath. the highest property tax rate, in virginia is 1.20% in manassas park city. Assessed value is determined by.

From www.texasrealestatesource.com

Texas Veteran Property Tax Exemption Disabled Veteran Benefits Property Taxes In Virginia the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. property taxes in virginia. The lowest property tax rate, is 0.41% in bath. Assessed value is determined by. the highest property tax rate, in virginia is 1.20% in manassas park city. 135 rows this interactive table ranks. Property Taxes In Virginia.

From cleverfinance.net

This Is How Much Property Taxes Value In All 50 States Clever Finance Property Taxes In Virginia property taxes in virginia. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. the highest property tax rate, in virginia is 1.20% in manassas park. Property Taxes In Virginia.

From www.youtube.com

SW Washington See's an Increase in Property Taxes VA Home Loans YouTube Property Taxes In Virginia The lowest property tax rate, is 0.41% in bath. property taxes in virginia are calculated by multiplying a home’s assessed value by its total property tax rate. Assessed value is determined by. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. the department of tax administration's (dta). Property Taxes In Virginia.

From exooosfbu.blob.core.windows.net

How To Look Up Personal Property Tax Va at Rebecca Spataro blog Property Taxes In Virginia the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. Assessed value is determined by. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. the highest property tax rate, in virginia is 1.20% in manassas park. Property Taxes In Virginia.

From varityhomes.com

The Homeowner's Guide to Arlington, VA Property Taxes Property Taxes In Virginia the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. property taxes in virginia. the highest property tax rate, in virginia is 1.20% in manassas park city. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local. Property Taxes In Virginia.

From www.dochub.com

Va 8453 Fill out & sign online DocHub Property Taxes In Virginia the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. The lowest property tax rate, is 0.41% in bath. the highest property tax rate, in virginia is 1.20% in manassas park city. the department of tax administration's (dta) real estate division is tasked with collecting data. Property Taxes In Virginia.

From www.youtube.com

How Much Virginia Personal Property Tax/Bill We Pay For Multiple Cars Property Taxes In Virginia The lowest property tax rate, is 0.41% in bath. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. the highest property tax rate, in virginia is 1.20% in manassas park city. the local tax rates survey is published by the department of taxation as a convenient reference guide. Property Taxes In Virginia.

From va-kreeg.blogspot.com

√ Does Veterans Pay Property Taxes Va Kreeg Property Taxes In Virginia Assessed value is determined by. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. property taxes in virginia are calculated by multiplying a home’s assessed value by. Property Taxes In Virginia.

From prorfety.blogspot.com

Personal Property Tax Halifax Virginia PRORFETY Property Taxes In Virginia 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. Assessed value is determined by. The lowest property tax rate, is 0.41% in bath. The average effective property tax rate in virginia is 0.81%, but this can vary quite a bit depending on which. property taxes in virginia are. Property Taxes In Virginia.

From www.fill.io

Fill Free fillable forms Montgomery County, Virginia Property Taxes In Virginia the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties,. Property Taxes In Virginia.

From exooosfbu.blob.core.windows.net

How To Look Up Personal Property Tax Va at Rebecca Spataro blog Property Taxes In Virginia The lowest property tax rate, is 0.41% in bath. property taxes in virginia. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. personal property taxes and real. Property Taxes In Virginia.

From elatedptole.netlify.app

Property Taxes By State Map Map Vector Property Taxes In Virginia Assessed value is determined by. the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. The lowest property tax rate, is 0.41% in bath. the highest property tax rate, in virginia is 1.20% in manassas park city. the local tax rates survey is published by the department of. Property Taxes In Virginia.

From www.ezhomesearch.com

Your Guide to West Virginia Property Taxes Property Taxes In Virginia the department of tax administration's (dta) real estate division is tasked with collecting data for all real property in. property taxes in virginia are calculated by multiplying a home’s assessed value by its total property tax rate. the highest property tax rate, in virginia is 1.20% in manassas park city. The lowest property tax rate, is 0.41%. Property Taxes In Virginia.

From www.uslegalforms.com

VA DoT 763 2019 Fill out Tax Template Online US Legal Forms Property Taxes In Virginia The lowest property tax rate, is 0.41% in bath. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. property taxes in virginia. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. the department of. Property Taxes In Virginia.

From exooosfbu.blob.core.windows.net

How To Look Up Personal Property Tax Va at Rebecca Spataro blog Property Taxes In Virginia property taxes in virginia. the highest property tax rate, in virginia is 1.20% in manassas park city. Assessed value is determined by. property taxes in virginia are calculated by multiplying a home’s assessed value by its total property tax rate. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of. Property Taxes In Virginia.

From elatedptole.netlify.app

Property Taxes By State Map Map Vector Property Taxes In Virginia property taxes in virginia. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. 135 rows this interactive table ranks virginia's counties by median property tax in dollars, percentage of home value, and. Assessed value is determined by. the local tax rates survey is published by the department. Property Taxes In Virginia.

From gustancho.com

VA Property Tax Exemption Guidelines on VA Home Loans Property Taxes In Virginia property taxes in virginia. personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. The average effective property tax rate in virginia is 0.81%, but this can vary. Property Taxes In Virginia.

From learningschoolhalamars.z19.web.core.windows.net

Va 2024 Tax Forms Property Taxes In Virginia the highest property tax rate, in virginia is 1.20% in manassas park city. The lowest property tax rate, is 0.41% in bath. the local tax rates survey is published by the department of taxation as a convenient reference guide to selected local tax. property taxes in virginia are calculated by multiplying a home’s assessed value by its. Property Taxes In Virginia.